Over the last three decades, Massachusetts has made a reasonably successful effort to shed the “Taxachusetts” label that once followed the Commonwealth like a shadow — but there’s at least one area where more work needs to be done.

Over the last three decades, Massachusetts has made a reasonably successful effort to shed the “Taxachusetts” label that once followed the Commonwealth like a shadow — but there’s at least one area where more work needs to be done.

That’s the estate tax.

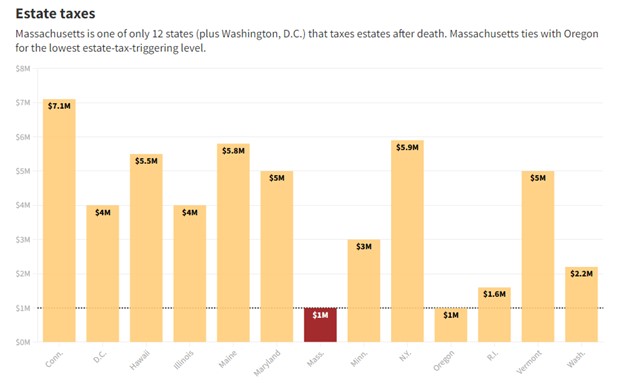

It’s not so much that the Commonwealth is one of only 12 states (plus Washington, D.C.) that taxes estates after death, but rather the way it’s done. The current estate tax, whose reach includes financial assets such as stocks, bonds, 401(k)s, IRAs, and proceeds from life insurance policies, as well as houses and other real estate, plus vehicles, boats, and assorted other possessions, kicks in at anything above $1 million in total value. Nationally, that ties Massachusetts with Oregon for the lowest estate-tax-triggering level.

One hardly needs to have been wealthy for an estate to trip on that earthly threshold when the person wanders across a more metaphysical one. Not in the Greater Boston area, where the median price of a single-family home hit $811,000 in June 2021. A person who has a home appraised at $700,000, plus a combined $275,001 in a 401(k) or IRA, and a vehicle worth $25,000 would hit that level.

“The low exemption has made it essentially a middle-class tax burden if you own real estate in the Commonwealth,” notes Eileen McAnneny, president of the Massachusetts Taxpayers Foundation.

Once an estate reaches the taxation threshold, Massachusetts has this unusual (and compared with other estate-tax states, regressive) feature: The tax isn’t assessed just on the value above $1 million. Rather, after a $40,000 exemption, the levy applies to the entire value of the remaining estate. (Oregon, contrariwise, only taxes the value of an estate in excess of $1 million.)

All that puts Massachusetts out of step not just nationally but even within New England.

To be sure, the estate tax is a good deal more avoidable than the grim reaper himself. It doesn’t apply to a couple’s jointly owned property or assets upon the death of the first spouse. The ownership of that simply shifts, untaxed, to the surviving party. For couples who have planned well, says Massachusetts lawyer and estate-planning specialist Harry S. Margolis, one common method of sheltering a larger percentage of an estate for their eventual heirs is to set up a trust to keep up to $1 million out of the estate of the surviving spouse but still available for her or his use if necessary. That’s allowable because each person has a $1 million exclusion, as long as they think to exercise it before departing this world. (There are, of course, other ways to shelter more of an estate, but many of them get positively baroque and require significant foresight and planning.)

For those who failed to do that pre-departure planning while they walked among us, however, the estate tax kicks in at the $1 million level upon the death of the second party.

To what degree state taxation drives relocation decisions is a hotly debated topic. Conservatives contend it does; liberals are dubious.

There isn’t any current study indicating that the Massachusetts estate tax itself is driving out-of-state migration among average retirees, though there is evidence of such an effect with the super-rich. However, anecdotally, various people say financial advisers have brought up the possibility of establishing one’s primary residence elsewhere as part of an estate-tax-reduction strategy.

“For these people, it’s not a matter of ‘packing up and moving to Florida,’ ” she said via e-mail. “It means that where before they considered Massachusetts their home but spent the winter in Florida, now they can spend an extra month or so in Florida, but also vote there and consider it their home.” That, she says, is what their financial advisers or CPAs will recommend.

So what’s to be done? State Representative Shawn Dooley, Republican of Norfolk and a former financial planner, has proposed eliminating the reach-down provision so the estate tax applies only to the estate value that exceeds the tax-tripping threshold. His plan would also allow an estate to realize the benefits of two personal exclusions even if a couple didn’t set up trusts. Both would be smart changes.

His plan also calls for setting the value of those personal exemptions at $2.75 million per person, with an additional exclusion of $2.75 million in primary-residence property value, the better to encourage people to stay domiciled in Massachusetts.

This article was an editorial featured by the Boston Globe on August 26, 2021, (The Massachusetts Estate Tax is Need of an Overhaul). There have been proposed changes to the estate tax made in the legislature however no major changes have been made to date.